AML Digital Transformation in International Bank

60%

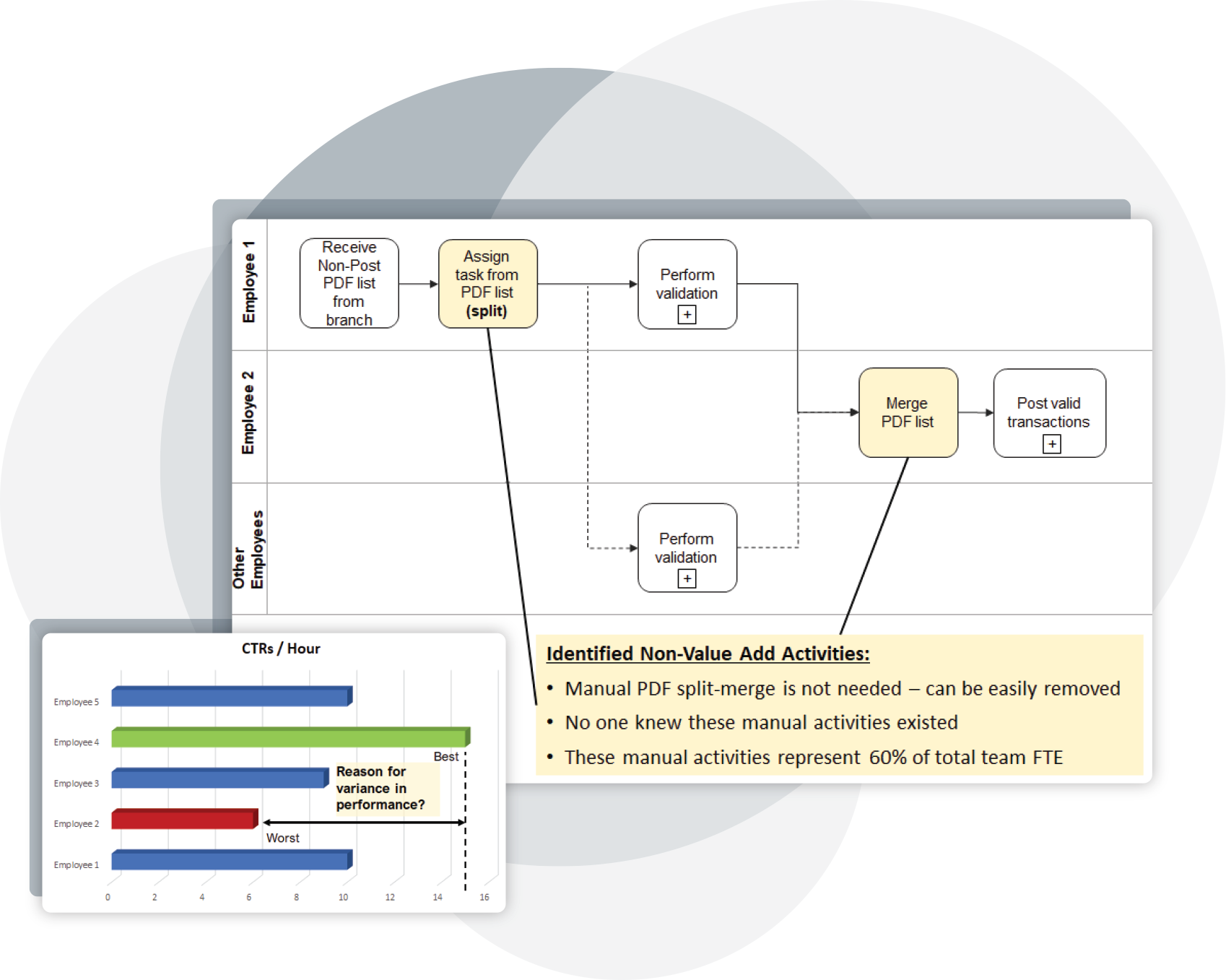

FTE Cost Savings in Non-Post Branch Validation.

40%

FTE Cost Savings in Funding and Onboarding of Home Equity Line of Credits (HELOC).

33%

FTE Cost Savings in Cash Transaction Reporting (CTR).

AML Operations Transformation

Revenue: $700M

Size: 3,200 Employees

Overview:

The AML process efficiency and employee performance was paramount to the bank which managed over $50B in assets. The AML operations included CTR, deposit verifications and fraud detection, KYC reviews, OFAC enforcement of economic and trade sanctions as well as credit review.

StereoLOGIC helped the bank to accelerate AML operations efficiency and identified significant FTE savings.

Challenge:

- Despite continuously increasing the number of AML Reviewers, the reviews took too long creating a backlog of transactions

- The process efficiency was very low with only 3-5% of review cases being real suspects

- The review process itself was inconsistent, with some reviewers performing excessive validations while others stopping at “just enough”

Solution:

StereoLOGIC provided the ability to:

- Reveal the E2E process performed by all team members

- Visualize work process of each reviewer (including activities, screenshots, and systems used)

- Measure the time of each process activity and the entire process

- Identify Non-Value Add activities

- Analyze deviations from the “optimum path” and visualize variances

- Generated Standard Operating Procedure documents for AML reviewers

Results:

- Provided visibility into AML reviewers work, discovering previously unknown reviewer processes

- Accelerated and improved reviewers’ work, eliminating Non-Value Add activities achieving up to 60% FTE cost savings

- Identified RPA opportunities

- Enabled efficient training following generated SOP documents

Case Studies

35%

INSURANCE COMPANY, TEXAS, US.

Saved over 35% of FTE

by optimizing Billing, Case

Implementation and Customer Service processes.

$15MM

CANADIAN BANK. Process optimization saved $15MM annually

and accelerated customer services by 22% using StereoLOGIC.

56%

PITNEY BOWES. Accelerated back-office operations by 56%

awhile reducing operating costs

by 30% and by 20% in errors...

4 weeks

WYTH FINANCIAL.

Customer Experience Improvement.

From 12 to 4 weeks

reducing the process analysis

and diagnostics time per process.

3x

Maximizing the Automation ROI and Acceleration of RPA Implementation.

Accelerated the bot

development 3x from over 11 weeks to 4 weeks.